Important of Zakat

Zakat is an important component of Islamic teachings and plays a significant role in maintaining a just and balanced society.

By obligating those who have accumulated wealth to donate a portion of their assets to the poor and needy, Zakat aims to create a society in which wealth is distributed fairly and those in need are supported by those who have the means to do so.

Zakat is also considered a form of social welfare and a means of purifying one’s wealth. By giving Zakat, Muslims are able to cleanse their wealth of any impurities and earn blessings from Allah for their generosity and compassion towards others.

The month of Ramadan is a particularly significant time for Zakat, as it is believed that the rewards for good deeds and charitable acts are multiplied during this month. Many Muslims choose to give their Zakat during Ramadan as a way to maximize their blessings and contribute to the well-being of their communities.

How To Calculate Zakat Eligibility

To determine if you are eligible to pay Zakat, you would first need to convert the value of your gold and silver to their equivalent in rupees. For instance, let’s say the current market rate for gold is 120,000 rupees per tola and the current market rate for silver is 1,500 rupees per tola. This means your 5 tola of gold is worth 600,000 rupees (120,000 x 5) and your 10 tola of silver is worth 15,000 rupees (1,500 x 10).

Next, you would add up the value of all your assets in rupees. In this case, your total assets would be 665,000 rupees (50,000 + 600,000 + 15,000).

Since your total assets exceed the Nisab amount of 80,933 rupees set by the Pakistani government, you would be eligible to pay Zakat.

To calculate the actual Zakat amount, you would need to multiply your total assets by 2.5%. In this case, your Zakat obligation would be 16,625 rupees (665,000 x 0.025).

For example

If you are calculating your Zakat on a day when the rate of gold in Pakistan is PKR 133,300 per tola, then the Nisab for gold would be calculated as follows:

Gold Nisab = Rate of Gold in Pakistan * 7.5 tola/3 ounces/87.3 grams of gold

Gold Nisab = PKR 133,300 * 7.5 tola = PKR 999,750

This means that if the total value of your savings and assets for a full lunar year is PKR 999,750 or more, then you are eligible to pay Zakat on them according to the gold Nisab.

On the other hand, if you are using silver to calculate the Nisab, and assuming that the rate of silver in Pakistan for that day is PKR 1,749 per tola, then the Nisab for silver would be calculated as follows:

Silver Nisab = Rate of Silver in Pakistan * 52.5 tola/21 ounces/612.36 grams of silver

Silver Nisab = PKR 1,749 * 52.5 tola = PKR 91,823

This means that if the total value of your savings and assets for a full lunar year is PKR 91,823 or more, then you are eligible to pay Zakat on them according to the silver Nisab.

Nisab for Zakat Explanation

The Nisab is the minimum threshold of wealth or assets that a person must possess before they are required to pay Zakat. In Pakistan, the Nisab for Zakat is determined based on the current market value of gold and silver.

If you calculate your Zakat based on the gold Nisab and the current rate of gold in Pakistan is PKR 133,300 per tola, then you would need to have assets worth more than PKR 999,750 (133,300 x 7.5 tola) for a full lunar year to be eligible to pay Zakat.

Zakat Nisab For Gold & Silver

Similarly, if you calculate your Zakat based on the silver Nisab and the current rate of silver in Pakistan is PKR 1,749 per tola, then you would need to have assets worth more than PKR 91,823 (1,749 x 52.5 tola) for a full lunar year to be eligible to pay Zakat.

It’s important to note that the Nisab can fluctuate based on the market value of gold and silver. So, it’s always a good idea to check the current rates before calculating your Zakat. Additionally, Zakat is calculated on an annual basis, so you need to maintain the required level of assets or savings for a full lunar year before you are required to pay Zakat.

It’s important to remember that Zakat is calculated on an individual’s net worth for a full lunar year. So if an individual’s assets drop below the Nisab limit at any point during the lunar year, they will not be eligible to pay Zakat until their net worth rises above the Nisab limit again for a full lunar year.

While there is no fixed date for calculating Zakat for individuals who are Sahib-e-Nisab throughout the year, it is recommended to calculate and pay Zakat during the month of Ramadan, as it is considered a blessed month in Islamic tradition and a time of increased generosity and charity.

Choice Of Nisab

The choice of Nisab ultimately depends on your personal circumstances and the types of assets you possess. If you only have assets and savings in gold, then it makes sense to use the gold Nisab. However, if you have mixed assets, including cash, gold, silver, and other commodities, then it’s best to use the silver Nisab.

Furthermore, it’s worth mentioning that different schools of thought may have different opinions on which Nisab to follow. Hence, if you’re unsure which Nisab to choose, it’s advisable to consult an Aalim-e-Deen for guidance. Ultimately, the most important thing is to ensure that you fulfil your Zakat obligation in accordance with Islamic teachings.

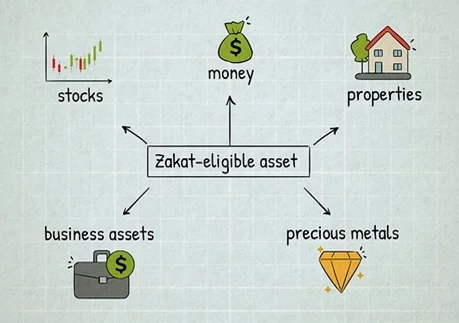

How To Calculate Zakat Eligibility

- Cash, whether it’s at home or in the bank.

- Foreign currency that you own, is valued at the conversion rate of the local currency.

- Savings that are set aside for a specific purpose, such as Hajj, marriage, buying a car, etc.

- The value of all the gold and silver that you own in your local currency, is based on the Nisab.

- The market price value of any shares that you might own if you wish to sell them.

- The dividend received from shares if you are not selling them in the near future.

- Money that is owed to you and will be repaid in the near future.

- Business owners should also include the balance sheet value of the stocks that they own.

- Rental property owners should tabulate any saved rental income as well.

- If a property is bought as an investment to be sold, then its market value is to be included.

- Anticipated profit on the sale of an investment asset in the near future.

Liabilities

The liabilities that should not be included in your Zakat calculations:

- Pending utility bills and credit card bills

- Pending rent owed to your landlord

- Outstanding personal loans or mortgages that you have taken

- The value of a property that you have rented out to a tenant

- Any amount due to your employees as their salary.

Masarif-e-Zakat

Musarif-e-Zakat refers to the recipients or categories of people who are eligible to receive Zakat according to Islamic principles.

These categories are mentioned in the Quran and include:

- Fakirs: These are people who are extremely poor and have no means to support themselves or their families.

- Masakeen: These are people who are also poor, but not to the extent of being considered fakirs. They may have some means to support themselves, but still require assistance.

- Amileen: These are people who are appointed to collect Zakat on behalf of the needy. They are usually knowledgeable and trustworthy individuals who are appointed by the Islamic authorities.

- Mu’allafatul-Qulub: These are people who are new to Islam or who are on the verge of leaving Islam. Zakat is given to them to encourage them to stay on the right path and become firm believers.

- Riqab: These are people who are in bondage or slavery and require assistance to regain their freedom.

- Gharimeen: These are people who are in debt and are unable to repay their debts. Zakat is given to them to help them clear their debts and become financially stable.

- Fi Sabeelillah: These are people who are involved in the propagation of Islam, such as scholars, preachers, and teachers.

- Ibnus-Sabil: These are travelers who are stranded and in need of assistance.

It is important to note that Zakat can only be given to these categories of people and should not be given to others who do not fall under these categories.

Zakat On Properties

Zakat is applicable on properties that are purchased with the intention of reselling them, such as investment properties, rental properties, or land.

The rate of Zakat for these types of properties is 2.5% of the net rental income or the property’s current market value, whichever is higher.

For properties that are owned and used for personal residence or business purposes, Zakat is not applicable. However, if the property is rented out and generates rental income, then Zakat is payable on that income.

It is important to note that Zakat is only payable on properties that are held as an investment or for generating rental income, and not on properties that are held for personal use.

Importance Of Zakat

Zakat holds great importance in Islamic teachings and has significance in various domains of life. Let me explain each of these in more detail:

Social Importance: Paying Zakat helps in fulfilling the social obligation of helping those in need, especially the poor and needy. It creates a sense of brotherhood and empathy among the Muslim community, strengthening social bonds and promoting mutual support.

Economic Importance: Zakat plays a vital role in the Islamic economic system as it helps in wealth distribution and reduces wealth inequality.It ensures that wealth is not hoarded by the rich and that everyone has a fair share of resources to live a dignified life. This promotes a healthy and just economic system.

Spiritual Importance: Paying Zakat is an act of worship and a means of purifying one’s wealth and soul. It helps in developing a sense of selflessness and compassion towards others, which is an essential aspect of Islamic teachings.

By paying , Muslims acknowledge that wealth is a blessing from Allah and that they have a responsibility to share it with others in need.

Social Benefits Of Paying Zakat

Paying Zakat has numerous social benefits. It helps to create a more equitable society by addressing issues related to poverty and wealth distribution. Some additional social benefits of Zakat are:

- It promotes compassion and empathy towards those in need.

- It fosters a sense of responsibility towards the community.

- It strengthens the bonds between individuals and communities by encouraging acts of charity and generosity.

- It provides a safety net for the vulnerable members of society, such as widows, orphans, and the disabled.

- It encourages the redistribution of wealth, which can help to prevent the concentration of wealth in the hands of a few.

- It promotes social cohesion by encouraging the wealthy to share their resources with the less fortunate.

- It helps to alleviate the burden on the state to provide for the poor and needy.

Faqs Related To Zakat In Pakistan

Is Zakat mandatory for all Muslims in Pakistan?

Yes, Zakat is mandatory for all Muslims who meet the criteria of being Sahib-e-Nisab, which means they have a certain minimum amount of assets or savings.

Can Zakat be given to non-Muslims in Pakistan?

cannot be given to non-Muslims in Pakistan. It is mandatory for Muslims to give Zakat only to other Muslims who meet the criteria of being eligible to receive it.

Can Zakat be given to organizations or must it be given directly to individuals in need?

can be given to both individuals and organizations as long as the organizations are recognized and authorized to collect Zakat. It is important to ensure that the Zakat is being used for the intended purpose and is reaching those who are truly in need.

Are there any exemptions for Zakat in Pakistan?

There are no exemptions for Zakat in Pakistan. It is mandatory for all eligible Muslims to pay Zakat if they have the minimum amount of assets or savings required to qualify as Sahib-e-Nisab.

However, there are some special circumstances where a person may be exempt from paying Zakat, such as if they are in debt or if they do not have enough assets to pay Zakat.

Can Zakat be given to family members?

cannot be given to immediate family members such as parents, grandparents, children, and grandchildren. However, it can be given to other relatives who are eligible to receive Zakat.

It is important to note that giving Zakat to family members is not recommended, as it may cause favoritism and bias in distributing the Zakat funds.

We have provided comprehensive information on calculating Zakat and the eligibility criteria. If you believe we have overlooked something or have any further questions, please do not hesitate to inform us.

For more informational blogs and updates on Shangrila city, head to our Facebook page or tune in to www.almeraajmarketing.com